Saturday, October 31, 2009

Thursday, October 29, 2009

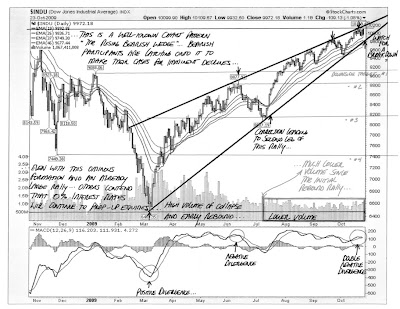

Beware Another Failed Head and Shoulders

Here is the thesis...

1) A decline is underway and is expected...

2) We have a valid H&S bottom that measures to 1230...

3) We had a failed head and shoulders top - highlighted in first rectangle...

4) It looks like we are repeating that pattern now...

5) We may hold 1020 and then continue higher for another leg up, like we did when the other h&s failed...

6) That would allow the 1230 target to be met and also allow for the over bullishness that could generate a real decline...

Apart From the Crowd - 10-30-09

Wednesday, October 28, 2009

Tuesday, October 27, 2009

Monday, October 26, 2009

BIDU - Looking Like S&P 500 Circa July 2007

I see that BIDU declined after hours. I put together this chart a couple of days ago and I thought to myself, "Boy, this looks similar to the double top that formed on the S&P500 circa the 2007 highs..." We'll see if the 20 day EMA holds...

Sunday, October 25, 2009

Saturday, October 24, 2009

Friday, October 23, 2009

Thursday, October 22, 2009

Wednesday, October 21, 2009

Tuesday, October 20, 2009

Friday, October 16, 2009

Annotated Japanese Yen

Yen - Monthly Chart - Since 1981

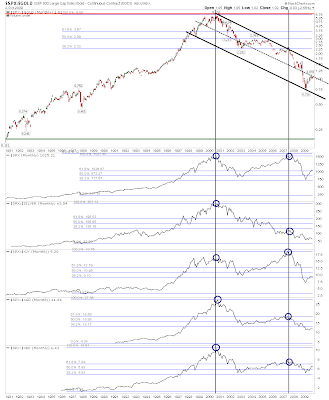

Right now, it seems the markets in general are focused on the future of the U.S. Dollar. Equities, commodities, bonds, and currencies are moving in relation to whether the U.S. Dollar weakens or strengthens. Lately, the direction has been decidedly down and there are various calls for the demise of the dollar. Some are technical chart calls. However, those technical calls invariable reflects a growing sentiment that the U.S. government has borrowed too much and confidence has been lost. Indeed, with talk of alternate currency schemes and replacement of the U.S. Dollar as the world reserve currency in the media, it seems that the prestige of the mighty U.S. may be inevitably tarnished. That being said, the U.S. Dollar is still above its all time lows, and it is rather near key support levels. So the question is, will the Dollar collapse? If it does, Dollar denominated asset prices will continue to rise precipitously. If it does not, we get a correction in the rally of Dollar denominated assets (gold, oil, stocks) that has been in force since the Oct. 2008- March 2009 timeframe.

The current overall sentiment for the Dollar seems decidedly negative. For instance, analyst Daisuke Uno of Sumitomo has opined that the Yen will appreciate violently against the U.S. Dollar to the point that the ratio will get to 50 Yen to the Dollar. Article from Bloomberg.com About Sumitomo Analyst Who Thinks Yen will Appreciate to 50 Yen Per U.S.Dollar

Yen Monthly Chart - Since 1991

The technical chart patterns on the long term charts posted above seem to give credence to this theory. We had a massive up move in the Yen off of the Plaza Accord in 1985. That topped out in 1994, and we've been in a consolidation lasting 14 years since then. Recently, we have had another major round of Dollar weakness and Yen strength, pushing prices out of the consolidation to the upside on a breakout. Seemingly, very bullish long term...

Others, like Serge Farra from ETF Corner, whose Yen Chart is below, see the Yen on a bearish reversal. This however, appears to be of a short to medium term timeframe. The candle sticks got a little ugly and the upmove out of the triangle seems to wan to consolidate further, meaning near term the Yen could go down versus the dollar.

Chart of Yen Circa 2008-2009 From Serge of ETF-Corner

Importantly, Marc Faber, who has been dead on recently, came out the other day and said that the dollar demise , along with the Gold and Equity rally may go on hold over the short term, with the Gold rally failing and equities declining up to 20%. That scenario would be Dollar bullish and Yen bearish.

Unfortunately, only time will tell whether the U.S Government and the Dollar will maintain its world hegemony going into the future. In fact, it would appear that the U.S. needs the Dollar to decline to lessen the impact of the massive debt and to inflate asset prices to placate the populace. Hold on, this could get bumpy...

Sources:

Dollar to Hit 50 Yen, Cease as Reserve, Sumitomo Says

By: Shigeki Nozawa

http://www.bloomberg.com/apps/news?pid=20601109&sid=a_A5nqmw9Dq8

October 15, 2009

FXY - Yen Bearish Reversal

By: Serge Farra

http://www.etf-corner.com/markets/2009/10/fxy-yen-bearish-reversal-.html

October 14, 2009

Right now, it seems the markets in general are focused on the future of the U.S. Dollar. Equities, commodities, bonds, and currencies are moving in relation to whether the U.S. Dollar weakens or strengthens. Lately, the direction has been decidedly down and there are various calls for the demise of the dollar. Some are technical chart calls. However, those technical calls invariable reflects a growing sentiment that the U.S. government has borrowed too much and confidence has been lost. Indeed, with talk of alternate currency schemes and replacement of the U.S. Dollar as the world reserve currency in the media, it seems that the prestige of the mighty U.S. may be inevitably tarnished. That being said, the U.S. Dollar is still above its all time lows, and it is rather near key support levels. So the question is, will the Dollar collapse? If it does, Dollar denominated asset prices will continue to rise precipitously. If it does not, we get a correction in the rally of Dollar denominated assets (gold, oil, stocks) that has been in force since the Oct. 2008- March 2009 timeframe.

The current overall sentiment for the Dollar seems decidedly negative. For instance, analyst Daisuke Uno of Sumitomo has opined that the Yen will appreciate violently against the U.S. Dollar to the point that the ratio will get to 50 Yen to the Dollar. Article from Bloomberg.com About Sumitomo Analyst Who Thinks Yen will Appreciate to 50 Yen Per U.S.Dollar

Yen Monthly Chart - Since 1991

The technical chart patterns on the long term charts posted above seem to give credence to this theory. We had a massive up move in the Yen off of the Plaza Accord in 1985. That topped out in 1994, and we've been in a consolidation lasting 14 years since then. Recently, we have had another major round of Dollar weakness and Yen strength, pushing prices out of the consolidation to the upside on a breakout. Seemingly, very bullish long term...

Others, like Serge Farra from ETF Corner, whose Yen Chart is below, see the Yen on a bearish reversal. This however, appears to be of a short to medium term timeframe. The candle sticks got a little ugly and the upmove out of the triangle seems to wan to consolidate further, meaning near term the Yen could go down versus the dollar.

Chart of Yen Circa 2008-2009 From Serge of ETF-Corner

Importantly, Marc Faber, who has been dead on recently, came out the other day and said that the dollar demise , along with the Gold and Equity rally may go on hold over the short term, with the Gold rally failing and equities declining up to 20%. That scenario would be Dollar bullish and Yen bearish.

Unfortunately, only time will tell whether the U.S Government and the Dollar will maintain its world hegemony going into the future. In fact, it would appear that the U.S. needs the Dollar to decline to lessen the impact of the massive debt and to inflate asset prices to placate the populace. Hold on, this could get bumpy...

Sources:

Dollar to Hit 50 Yen, Cease as Reserve, Sumitomo Says

By: Shigeki Nozawa

http://www.bloomberg.com/apps/news?pid=20601109&sid=a_A5nqmw9Dq8

October 15, 2009

FXY - Yen Bearish Reversal

By: Serge Farra

http://www.etf-corner.com/markets/2009/10/fxy-yen-bearish-reversal-.html

October 14, 2009

Wednesday, October 14, 2009

Martin Armstrong Newsletter PDF's

Read "It's Just Time" by Martin Armstrong

See This Site For Copies of Martin Armstrong's Interesting Newsletters From Federal Prison

http://www.martinarmstrong.org/

Monday, October 12, 2009

Saturday, October 10, 2009

Thursday, October 08, 2009

Annotated Platinum

This is my comment to the post of this chart at the Big Picture...

With respect to Gold, it is probably outperforming the rest because it is least tied to actual economic activity. I’m thinking that Aluminum and Platinum are lagging the rest because of their connection to the Auto industry. Copper is doing relatively well with the massive China buying and hopes for an economic recovery on the horizon. Silver is doing fairly well though not as well as Gold. I’m thinking that it is due to its hybrid quality of precious metal (inflation hedge) and industrial metal…

I do these charts as a way to get people to discuss the issues, and to hear what the readers are thinking, not to enforce my view on them. I never felt the need to do this before but I should mention that I have no investment positions in any of these metals, futures tied to these metals, or in any stocks in the metals space.

If I were to glean anything from this chart re: actual trading advice, the dashed line around $1359, has been acting as a key support and resistance level throughout the timeframe depicted in this chart. Therefore, if it breaks out above that level, I would buy it on a retest of the breakout as it pulls back to what would then be support around the 1360 area. This way good stops could be put in position to litigate your downside risk.

Wednesday, October 07, 2009

The Guy Bagging My Groceries Just Told Me That Gold Broke Out To New Highs and That The Dollar is Finished

I have to admit that on the Daily charts, GOLD looks extremely likely to continue higher.

On the long term charts, it is in a strong sustained uptrend.

The sentiment situation seems out of whack and skewed to the upside.

The good thing is that you can be long with a defined stop loss somewhere around the $1000 level.

Sentiment Alerts:

Last night on CNN they told me that the dollar was finished and that GOLD was at new highs.

Today on Bloomberg, literally everyone and their mother was quoted as calling for GOLD higher.

Short Term GOLD

Long Term GOLD

Long Term Goldcorp

On the long term charts, it is in a strong sustained uptrend.

The sentiment situation seems out of whack and skewed to the upside.

The good thing is that you can be long with a defined stop loss somewhere around the $1000 level.

Sentiment Alerts:

Last night on CNN they told me that the dollar was finished and that GOLD was at new highs.

Today on Bloomberg, literally everyone and their mother was quoted as calling for GOLD higher.

Short Term GOLD

Long Term GOLD

Long Term Goldcorp

Saturday, October 03, 2009

Friday, October 02, 2009

Subscribe to:

Comments (Atom)